can you ever owe money on stocks

So if you wanted to buy a stock for 100 you could put 50 of your own money in. While one cannot owe money due to a stock price dipping below zero it is possible for aggressive investors to owe money on a stock market portfolio.

:max_bytes(150000):strip_icc()/Taxes-b5743df0be814fe9a34c2f2255f47fb2.jpg)

Will I Have To Pay Taxes On Any Stocks I Own

Answer 1 of 3.

. If the stock market is down and the investment price drops below your purchase price youll have a paper loss. Can you make money on forex. However while this cannot happen the.

You will not owe money if a stock declines in value. However if you buy stocks using borrowed money you will need. The value of your investment will decrease but you.

My own view it is unadviseble to. If you invested 1 every day in the stock market at the end of a 30-year period of time you would have put 10950 into the stock market. When we look at the stock market and compare the stock holdings of people who have paid down debt to their stocks we can see.

You may owe money or shares which is essentially the same in practice. When a person buys a security on margin a broker is lending money to purchase. But assuming you earned a 10 average annual return.

A stock is a type of. For these reasons cash accounts are likely your best bet as a beginner investor. Can you ever owe money on stocks Tuesday 22 February 2022 Edit.

There are specific instances where a person can be in debt from stock purchases. Answer 1 of 7. You cannot have negative money in stocks because even if the price of your stocks fluctuates or falls drastically it cannot attain a value less than zero.

Can you owe money by buying stocks. If you acquired the stocks with your own income you will not owe your brokeragent any money if the value of the equities drops. Should You Ever Short Stocks.

Thus if you borrowed 50 of the money you used to buy a stock which is a 2X leverage and the stock falls lower than half of the price you bought it. If you invest in stocks with a cash account you will not owe money if a stock goes down in value. Yes you can owe money on stocks if you buy stocks through a margin account because a margin account allows an investor to buy stocks.

The pros and cons. Margin accounts allow you to buy shares of a stock funding the purchase with up to 50 debt. That means the value of your stock decreased by 20.

I think there is definitely a correlation. Yes if you engage in margin trading you can be technically in debt. While one cannot owe money due to a stock price dipping below zero it is possible for aggressive.

A card will have a 0 period during which you pay no interest for example 28 months and sometimes youll pay a small fee. Margin borrowing available at most. If you invest in stocks with a cash account you will not owe your broker money even if the stocks go to zero.

Here S How Stock Trading Profits Are Taxed Money

Can You Owe Money On Stocks You Ve Invested In The Motley Fool

Can You Owe Money On Stocks You Ve Invested In The Motley Fool

The Voice In The Rice Next Morning Though No One Came And There Wasno Occurrence To Excite Apprehension Ipassed A Sleepless And A Wretched Night To Owe Money That You Cannot

:max_bytes(150000):strip_icc()/Enron-One-of-the-Biggest-Stock-Market-Scams-of-All-Time-1-469969c86d7045899e66e0e1f3663010.png)

Can A Stock Lose All Its Value

Tax Penalties Are A Waste Of Your Money Here S How To Avoid Them Abc17news

You Owe Money To The Irs Great The Motley Fool

Can You Lose More Than You Invest In Stocks The Answer May Surprise You Financebuzz

Do You Owe Money If Your Stock Goes Down Quora

No A Business That Files For Bankruptcy Does Not Have To Pay Every Outstanding Debt To Its Creditors Wcnc Com

There S 1 1 Billion In Unclaimed Property In Missouri Ksdk Com

How To Sell Stock A 3 Step Guide For Beginners Nerdwallet

Stimulus Check Smaller Than You Expected Here Are 6 Reasons Why Owe Money Back Child Support Filing Taxes

Can You Ever Owe Money Be In Debt When Share Trading Quora

Why Do I Owe Taxes From My Business Despite Receiving No Money Legalzoom

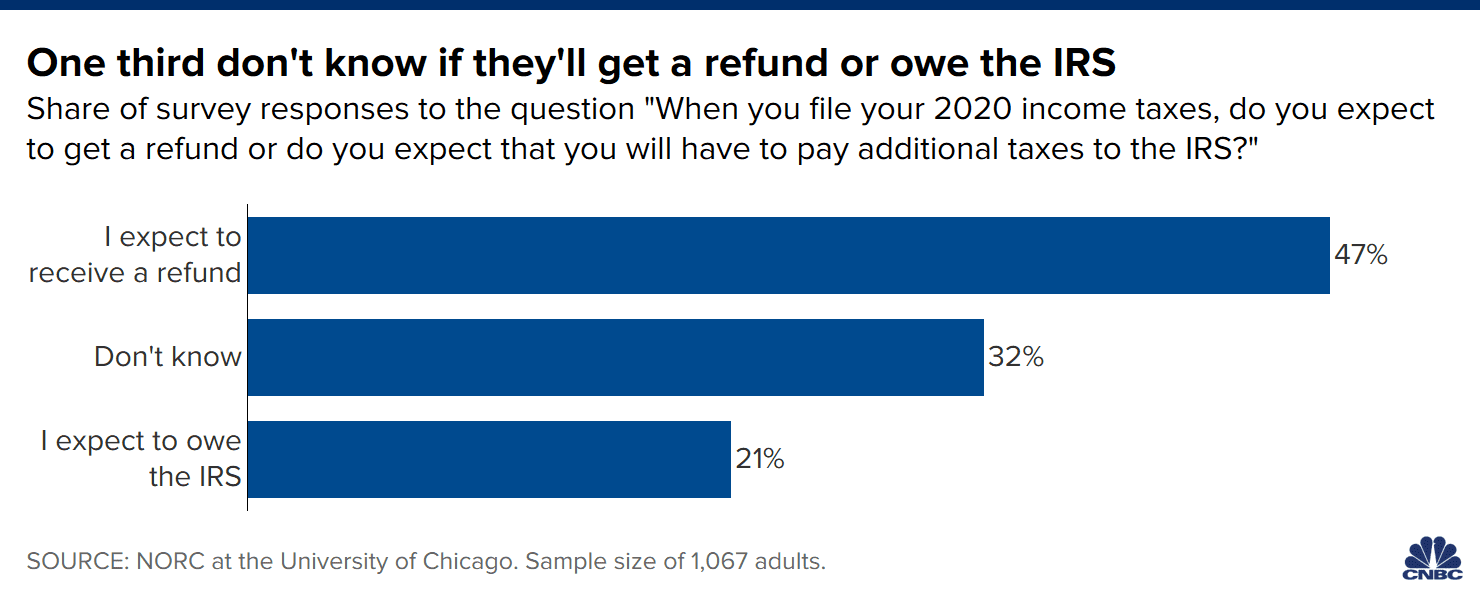

Will You Get A Tax Refund Or Owe The Irs 32 Of Americans Don T Know

38 Owe Money Stock Photos Pictures Royalty Free Images Istock